Financial Aid – Pembroke Campus

The Financial Aid team is here to provide you with support and resources over the course of your studies. From OSAP, Travel Awards and Bursaries we want to make your experience the best! Have questions? Have a look around! We’re sure you’ll find what you are looking for.

Ontario Student Assistance Program (OSAP)

What is OSAP?

The Ontario Student Assistance Program (OSAP) is a financial aid program that can make it easier for students to pay for college.

OSAP offers two different types of funding:

- Grants: money you don’t have to pay back

- Loans: money you need to repay

BONUS: You can decline the loans and only accept grants (free money!).

Start your application

Applying for OSAP is easy and only takes about 10 minutes!

Questions? We’re here to help.

Learn more about OSAP. If you have questions about your OSAP application, contact your Financial Aid Officer.

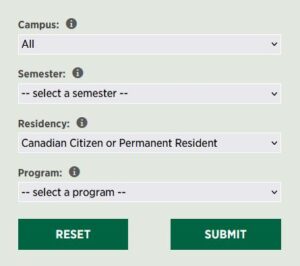

Tuition and Fees Estimator for Full-time Programs

Investing in your education is one of the most important things you can do. How much will a program at Algonquin cost? Customize your search criteria to see the estimated full-time tuition and compulsory ancillary fees by program. Your estimate will show tuition, and compulsory ancillary fees. Learning resources (ex. textbooks) and living costs (ex. housing/residence, food, etc) are not included.

Please note the following fees are not included in the Estimator:

*Program tuition and fees may differ from what is displayed based on student-specific course loads and level of study. Ancillary fees are reviewed on an annual basis and any changes are approved by the College’s Board of Governors.

Full-Time Students

The Ontario government and federal government provide this money. Through one OSAP application, you have access to a mix of different financial aid programs, depending on your circumstances. If you apply for OSAP, you are automatically considered for grants too. You don’t need to apply separately.

Try the online OSAP Approximator now to see how much funding you may be eligible for!

Who is eligible? Click here to learn more

- You must be a Canadian citizen, protected person or permanent resident of Canada.

- You must be an Ontario resident (living in Ontario for at least 12 months immediately prior to your study period).

- You must be registered in full-time studies taking at least 60% course load; 40% for students with a permanent disability.

- You must maintain satisfactory academic progress.

- Your previous OSAP student loans must be in good standing.

How to Apply Click here to learn more

When you apply for Full-time OSAP, you are automatically considered for all provincial and federal loans and grants. You must apply once per academic year. We recommend that you apply at least 3 months before the start of your study period to avoid delays with your funding.

Did you know that you can decline the loans and opt for the grant funding only?

Don’t forget to submit all your OSAP documents using the OSAP portal. This ensures your application will be reviewed as soon as we are able. Find out how to submit documents.

Part-Time Students

The Ontario government and federal government provide this money. Through one OSAP application, you have access to a mix of different financial aid programs, depending on your circumstances. If you apply for OSAP, you are automatically considered for grants too. You don’t need to apply separately.

Part-time OSAP only covers the cost of tuition, books and day-care costs if applicable. Unlike, full-time OSAP it does not cover living expenses.

Who is eligible? Click here to learn more

- You must be a Canadian citizen, protected person or permanent resident of Canada.

- You must be an Ontario resident (living in Ontario for at least 12 months immediately prior to your study period).

- You must be registered in 20% -59% of an eligible program’s course load; with the exception of students with a permanent disability.

- You must maintain satisfactory academic progress.

- Your previous OSAP student loans must be in good standing.

What programs are eligible? Click here to learn more

Not all Algonquin College part-time programs are eligible for OSAP funding. It is important to check whether your program is eligible before you apply.

How to Apply Click here to learn more

When you apply for Part-time OSAP, you are automatically considered for all provincial and federal loans and grants. You must apply once per term.

Out of Province Financial Aid Applicants

Students applying for government financial aid from a province or territory other than Ontario may also apply for the tuition deposit deferral. Please apply through www.algonquincollege.com/ro/tde and be prepared to supply a copy of their needs assessment.

The Registrar’s Office will advise you of the result of your application.

OSAP FAQs

Start of Term

When do I apply for OSAP?

Apply as soon as possible. You don’t have to wait to be accepted into your program of choice before you apply.

How do I submit my supporting documentation for OSAP?

Upload to your OSAP application.

When should I submit the documentation?

Submit early. Processing time is 4-6 weeks.

How do I check the status of my application?

You can check status of your OSAP application online.

When will I get the funds?

You will get your installment within the first 10 days of the term provided there is no outstanding documentation.

How is OSAP paid?

OSAP is paid in 2 installments only: 60% and 40%. Budget carefully.

Whom do I contact if I have questions?

If you have any questions, please contact the assigned Financial Aid Officer for your program. Email us here.

OSAP Updates

Students should regularly check the Message Centre in their OSAP account for messages and updates regarding their OSAP.

OSAP Document Processing Time

It is currently taking 3-6 weeks from the date of submission to review OSAP documents. Once reviewed, the status will indicate whether the submitted document is approved or denied.

- Students should check for the following information in the ‘Required Documents’ section in their OSAP account.

- ACCEPTABLE DOCUMENTS: Students should read the description and the list of acceptable documents, and submit exactly what is required for each document.

- DEADLINES: Students should check the ‘Document deadlines to consider’ link to ensure that they meet the applicable deadlines.

OSAP Funding Release

Once confirmation of enrolment is processed, it will take the Ministry 5-10 business days to release the funding. Eligible students (with all their OSAP documents approved by mid-December) can expect their funding around the first week of class.

Updating Banking Information for OSAP

If students need to update their banking information for OSAP, they can use the Bank Account Change Request form in the National Student Loans Service Centre (NSLSC) toolbox.

Other Financial Aid Questions?

For any other financial aid questions, including OSAP, you can contact your assigned Financial Aid Officer.

Deposit and Tuition Fee Payment Information

Tuition Deposit

IMPORTANT NOTICE: Tuition Deposit Payments for Domestic Students

All full-time students, new and returning, must pay a $500.00 non-refundable Tuition Deposit in their initial term of an academic year. This non-refundable $500.00 deposit payment secures their seat in that program for the year and is put towards the balance of fees owing for that term. Please view the Payment Due Dates site for more detailed due date information.

Upon payment of the $500.00 non-refundable Tuition Deposit, the remaining fees are deferred automatically and the student is provided with an email indicating their Balance Due Date. The Balance Due Date will be at the end of the first month of their term. If a student is late paying that remaining balance, they will be assessed a $150.00 late payment penalty.

Are you a New Student?

Are you a Returning Student (Initial Term)?

Are you a Returning Student (Subsequent Term)?

Are you a Sponsored Student?

Payment Options: Learn more about your payment options. Credit card payments are not accepted for students registered in full-time programs. All students whose fees are received after the Balance Due Date will be charged a late-payment fee of $150.

Tuition Deposit Deferral

$500.00 non-refundable tuition deposit deferrals (OSAP students)

Algonquin College students who have applied for OSAP are eligible for a deferral of their $500.00 non-refundable tuition deposit. Eligible students must have applied for OSAP funding for the applicable academic year and be receiving enough funds in their first OSAP installment to pay for their first semester tuition and compulsory fees.

IMPORTANT NOTE: After you have completed your tuition fee deferral, should your circumstances change and you become ineligible for government financial aid, you will be liable for the $500.00 non-refundable, tuition fee deposit irrespective of your decision to continue your studies.

Should you wish to withdraw from your program of study for any reason, you must inform the Registrar’s Office in writing within 10 business days of the start of your program to be entitled to a refund of your tuition fees for the term less the tuition fee deposit. Failure to do so will render you liable for the full tuition fees incurred for the term.

OSAP and Out-of-Province Financial Aid Applicants

Eligible students who have successfully applied for OSAP or Out-of-Province Financial Aid for the Fall term can defer their $500.00 non-refundable tuition deposit on their ACSIS account by clicking on “Defer Your Fees” under the FEES & PAYMENTS Menu Options.

Tuition Deposit FAQs

Do I need to make a tuition deposit?

Would I ever need to make more than one tuition deposit in an academic year?

Is my tuition deposit a payment against my program tuition fees?

When is my $500.00 tuition deposit due?

What if I change my mind after making my tuition deposit but before the start of the term?

What if I withdraw after my tuition fees have been paid in full?

When is the balance of my tuition fees due?

What if my fees are not paid in full by the due date?

What financial assistance is available to help with my education expenses?

What if I have applied for OSAP or Out-of-Province financial aid and will be receiving funding?

What if I do not meet my admission conditions after I have paid my tuition deposit towards that program?

Do I need to make a tuition deposit?

One $500 non-refundable tuition deposit per academic year (September – August) will be required. OSAP and Out-of-Province financial aid applicants may be eligible to defer their $500 non-refundable tuition deposit through their ACSIS account. The $500 tuition deposit will be requested in your first study term each year and will be applied to your fee balance. In most cases, the first study term will be in the Fall.

Would I ever need to make more than one tuition deposit in an academic year?

You would need to make more than one tuition deposit payment or deferral in an academic year only if you elect to switch your program of study during the academic year.

Is my tuition deposit a payment against my program tuition fees?

Yes, your $500 tuition deposit payment will be applied towards your term tuition fees. This payment will reduce the balance of the term fees that will be due three weeks after the start of your term.

When is my $500.00 tuition deposit due?

If your first study term of the academic year is Fall, your deposit will be due June 15

If your first study term of the academic year is Winter, your deposit will be due November 15

If your first study term of the academic year is Summer, your deposit will be due April 1

Note: If any of these dates fall on a holiday or weekend, the due date for fee payment or deferral for OSAP applicants will be the first working day following the holiday/weekend.

What if I change my mind after making my tuition deposit but before the start of the term?

Your $500 tuition deposit is non-refundable if you decide to not attend Algonquin College. If you are only making changes to your program choice at Algonquin, your $500 non-refundable tuition deposit will be applied against the tuition for your new program at Algonquin College.

If you are an OSAP or Out-of-Province financial aid applicant who completed a tuition deposit deferral on ACSIS, and decide to no longer attend Algonquin College or are ineligible for government financial aid, you will be liable for the $500.00 non-refundable tuition fee deposit.

What if I withdraw after my tuition fees have been paid in full?

If you withdraw up to the 10th day of class, you will be eligible for a refund of the full tuition and ancillary fees paid for the term less the $500 non-refundable tuition deposit.

If you completed a tuition deposit deferral on ACSIS, and withdraw up to the 10th day of class, you will be liable to pay the $500.00 non-refundable tuition fee deposit. If the college has received any OSAP payments within this time period, the remaining credit (less the $500 non-refundable tuition deposit) will be returned to the National Student Loans Service Centre.

If you withdraw after the 10th day of class, you are responsible to pay the full fees for that term and will not be eligible for a refund.

When is the balance of my tuition fees due?

The remaining balance of your tuition fees will be due three weeks after the start of your term. You will be receiving a tuition deposit confirmation email once you have made your tuition deposit payment or deferment, giving you an exact date as to when your remaining balance will be due for that term.

We encourage you to use online methods of payments and to not wait until the last day to make your payment. When paying by online banking or telephone banking please allow 3 days for processing. By paying early and paying online you will avoid line-ups and long waits at the Registrar’s Office and be able to focus on your studies.

What if my fees are not paid in full by the due date?

A late fee of $150 will apply the next day if your fees are not paid in full by the balance due date each term. Avoid the late fee by paying your remaining balance in full by the balance due date (provided in your tuition deposit confirmation email).

What financial assistance is available to help with my education expenses?

Finding the funds to pay for tuition, housing, books and supplies can be a challenge. Please visit the Algonquin College Financial Aid & Student Awards website for information regarding student loans, bursaries and other forms of financial assistance available to students.

What if I have applied for OSAP or Out-of-Province financial aid and will be receiving funding?

Algonquin College Students who have applied for OSAP or Out-of-Province financial aid may be eligible for a deferral of their $500.00 non-refundable tuition deposit.

Eligible students who have successfully applied for OSAP or submitted their Out-of-Province financial aid paperwork to the Financial Aid and Student Awards Office can defer their $500.00 non-refundable tuition deposit on their ACSIS account by clicking on “Defer Your Fees” under the FEES & PAYMENTS Menu Options.

What if I do not meet my admission conditions after I have paid my tuition deposit towards that program?

If you do not meet the admission conditions for your program by the start of term and as a result are not allowed entry into that program at Algonquin College, your $500 tuition deposit will be refunded.

Bursaries & Awards

How to Apply for Bursaries

Bursary Applications

How to Apply

Students can apply for all in-year bursaries administered by Algonquin College by submitting one application!

The application cycle is open once per term (Fall, Winter, Spring). Only registered students for the current term can apply online through the ACSIS Bursary Portal.

- Go to acsis.algonquincollege.com

- Sign in with your student number and password, or create a new login

- Under the Financial Aid heading click on ‘Bursary Portal’.

Applying for a bursary does not guarantee acceptance, as the number of applicants can often surpass the bursary funds available. When this occurs, applicants are chosen based on the highest amount of financial need. Bursary applications received after the deadline will not be accepted.

Students awarded a bursary are required to have their Social Insurance Number (SIN) registered on the college system for income tax purposes. If you do not have your SIN registered with the college when you submit your application, an email notification will be sent to you with instructions.

How an Awarded Bursary is Paid Out

If you currently owe fees to Algonquin College your bursary will first be put towards your student account. If you are expecting to return next semester, your bursary will be added to your student account to go towards your future fees. If you withdraw from your program you are no longer eligible to receive this bursary and it will be removed.

If you are in a graduating level or are a sponsored student, you will receive a cheque by mail for the remaining balance of the bursary. Please review your address on your ACSIS account.

The bursary applicant pool is constantly changing so there is no guarantee you will receive a bursary next time. As a result, we strongly recommend your budget for the rest of the year does not include it.

If you are currently an OSAP recipient, you do not have to report the bursary to OSAP; we will do so on your behalf.

For more information please email studentawards@algonquincollege.com or visit one of our Financial Aid Officers in the Admissions Office, Room 133 and 134.

AC Aid

What is AC Aid?

It’s money for your education at Algonquin. We offer entrance bursaries and scholarships to make paying for college easier. AC Aid helps you focus on your studies, not your bank account!

AC Aid: Entrance Bursaries

What’s better than a world-class education? Getting help to fund it!

To qualify, you need to:

- Be a first-time Algonquin College Student

- Be entering Level 1 of an eligible program

- Apply for the bursary online through your ACSIS account

- Be approved for OSAP

- Have a demonstrated financial need

International Students and students registered in Apprenticeship, Bridging, Contract and Graduate Certificate programs are not eligible.

Entrance Bursaries are awarded based on financial need. We expect the number of applicants to be greater than the bursaries available so applicants are not guaranteed to receive an Entrance Bursary. Decisions will be made by early October and applicants will receive an email notification.

AC Aid: Entrance Scholarships

If you’re interested in one of our degree programs, you may qualify for even more AC Aid!

We offer a $1,000 entrance scholarship for full-time degree students with a grade 12 GPA of 80% or higher. To qualify, you need to:

- Apply for one of our non-collaborative degree programs*

- Enter Level 1 of your program (students with Advanced Standing or who are entering one of our bridging programs are not eligible)

- Have a grade 12 GPA of 80% or higher

- Confirm your offer of admission before May 1

- Be a Canadian resident or permanent resident

*Students who apply for a collaborative degree program will be assessed for entrance scholarships from the partnering university.

If you’re awarded an AC Aid Scholarship, it will be automatically credited to your Algonquin account as long as you confirm by May 1.

Questions?

We’re Here 2 Help! bursaries@algonquincollege.com or 613-735-4700 x2709.

Canerector Foundation Scholarship in the Skilled Trades

The Canerector Foundation is a registered, non-profit Canadian charitable organization founded in 2019 by the Hawkins family. The foundation has donated more than $2.7 million to worthy Canadian charities in the housing, education, food insecurity and health care sectors across the country, as well as around the world.

Canerector Inc. grew from a small team of tradesmen to the large group of companies it is today, and strives to give back to the communities that have supported us.

AWARDS

- Canerector Foundation Scholars will receive an initial value of $1,000 applied towards student accounts.

- Scholars who mentor current and prospective students in skilled trades; participate in co-curricular activities; and maintain a minimum of 3.0 grade point average will be awarded an additional $1,000 per term, up to a maximum of $4,000.

Eligible Programs in Pembroke:

- Carpentry and Renovation Techniques

Proceed to Application

AC Bursaries

Funds for bursaries marked with an asterisk are matched through the Ontario Trust for Student Support (OTSS). To be eligible, you must be a Canadian Citizen and have been a resident of Ontario for at least 12 consecutive months, and must not have attended full-time post-secondary studies in the year prior to submitting your bursary application.

Angus Campbell Bursary

Awarded to two students who are entering 2nd year of a post-secondary program who show financial need.

Art Gallagher Memorial Bursary

To be distributed annually to a Pembroke Lumber Kings Junior “A” Hockey Player that is registered either full or part-time at the Pembroke Campus. It is to be disbursed during the winter semester of the academic year, based on financial need. Preference is to e given to a player from the Upper Ottawa Valley.

Barbara Ingram Janet McCarthy & W.J. P. Robertson Memorial Bursary

The Barbara Ingram, Janet W. McCarthy and W.J.P. Robertson Memorial Bursary has been established for a full-time first-year student graduating from a high school in the National Capital Region with a physical disability who demonstrates financial need.

Canadian and Turkish Women’s Association of Ottawa Bursary

Awarded to a student(s) at the Ottawa, Perth, or Pembroke campuses who can demonstrate financial need. Special consideration will be given to female student(s) who lead a single-parent household.

Canadian Federation University Women-Kanata Chapter Bursary

Awarded to a full-time mature female student who can demonstrate financial need.

Charles Butler Bursary

Awarded to students at the Pembroke Campus who can demonstrate financial need.

Don East Memorial Bursary

Awarded to students in any full-time program at any campus who can demonstrate financial need. Special consideration is given to students from rural areas.

Douglas Arthur de Pencier Bursary

The Bursary is awarded to (2) two students entering the first year of their first program who can demonstrate financial need. The Bursary is open to students whose residence during the two years preceding the award was within the limits of the Geographic Townships of Oxford-on-Rideau and Wolford in the Count of Grenville, the Township of Montague in the County of Lanark and the Township of Marlborough in the Count of Carleton.

Ed Ireland Pembroke Bursary

Awarded to one student at the Pembroke Campus who can demonstrate financial need.

The Bursary is open to Canadian citizens, permanent residents and international students. The Bursary is for students at the Pembroke Campus. The Bursary is to be disbursed during the Winter semester.

Girls Night Out Bursary

Awarded to one full-time female student who is from Renfrew or Pontiac counties prior to enrolling at the Pembroke Campus and admitted to or enrolled in any program at the Pembroke Campus leading to a Certificate, Diploma or Degree at the Pembroke Campus who demonstrates financial need.

Grand & Toy Bursary*

Awarded to a student(s) who can demonstrate financial need.

Ian Henderson Bursary

The Ian Henderson Bursary is awarded to a student enrolled in the Practical Nursing program who can demonstrate financial need.

IODE Lorraine Chapter Bursary

The IODE Lorraine Chapter Bursary has been established for a mature female student who has demonstrated financial need.

James McNulty Bursary

The James McNulty Bursary is awarded to one student in their 3rd semester enrolled in the Faculty of Health and Community Studies Practical Nursing program who can demonstrate financial need. The Bursary is for an Indigenous student, a Black student or a recent immigrant, having arrived in Canada within the last 5 years. The Bursary is open to a Canadian citizen, landed immigrant, permanent resident, or a protected person. The Bursary funds are to be disbursed at the beginning of the fall or winter term. The Bursary is open to students enrolled at the Ottawa, Perth, or Pembroke Campus where the Nursing program is offered.

Jason Blaine Bursary

Awarded to students at the Pembroke Campus who demonstrate a need for financial aid.

Johannah Raphael Nursing Bursary

The Johannah Raphael Nursing Bursary is awarded to mature students enrolled in the Practical Nursing program who can demonstrate financial need. In order for an applicant to be considered for the Bursary, the applicant must meet the following criteria:

- The applicant must be a Canadian citizen, permanent resident or international student.

- The applicant must be a mature student. Mature student is defined as someone who is 25 years of age at the time they apply for the Bursary.

- The applicant must be enrolled in the Practical Nursing program at either the Ottawa, Perth, or Pembroke Campus where the Program is offered.

John & Caroline Dunfield Bursary

Awarded to a student during the 2nd semester of the Forestry program at the Pembroke Campus who can demonstrate financial need.

John Escott Rotary Club of Pembroke Memorial International Student Burary

Awarded to an international student enrolled in a full-time Certificate, Diploma or Degree program at the Pembroke Campus who can demonstrate financial need. The Bursary is open to international students studying at the Pembroke Campus in the Winter term.

John Tattersall Bursary for Women in STEM

For a female student in a Science, Technology, Engineering, or Mathematics program.

Kildonan Education Bursary

The Kildonan Education Bursary has been established for a first-year full-time student who has graduated from a high school in the National Capital Region and who demonstrates financial need.

Leacross Foundation Bursary for Women in STEM

Leacross Foundation Bursary for Women in STEM will support (20) twenty female students who can demonstrate financial need. Each recipient will receive $2,000. Candidates must be enrolled as full-time students in the Computer Systems Technician program. The Bursary is open to Canadian citizens, permanent residents and international students. The Bursary funds are to be disbursed at the beginning of the winter term. The Bursary is open to students enrolled at the Ottawa, Perth, or Pembroke Campus where the programs are offered.

Mabel Campbell Deslaurier Memorial Bursary

Awarded to a student in the Outdoor Adventure Naturalist program who maintains a high academic standing and demonstrates a need for financial aid.

Margaret Proulx Bursary

Awarded to one student during the 2nd semester in the Personal Support Worker program at the Pembroke Campus who can demonstrate financial need.

NRTC Communications Bursary

Awarded to a student during the winter semester of the 1st year of the Computer Systems Technician program at the Pembroke Campus.

Organization of Canadian Nuclear Industries Bursary

Awarded to a first or second-year Indigenous student enrolled in the Applied Nuclear Science and Radiation Safety program.

Pamela George Financial Literacy Bursary

The Bursary is awarded to one female student who can demonstrate financial need. The Bursary is for a mature student who is 25 years of age at the time they apply for the Bursary. The Bursary is for a racialized student and encourages applications from Indigenous and Black learners. The Bursary is open to a Canadian citizen, landed immigrant, permanent resident, or a protected person. The Bursary funds are to be disbursed at the beginning of winter term. The Bursary is open to students enrolled at the Ottawa, Perth, or Pembroke Campus.

Pembroke Regional Hospital Auxiliary Bursary

Awarded to students enrolled in either Bachelor of Science and Nursing and Practical Nursing programs at the Pembroke campus during the 5th semester if in the 4-year degree program or 3rd semester for the Practical Nursing program who can demonstrate financial need

Renfrew County Chapter of Ontario Woodlot Association Bursary

The Renfrew County Chapter of Ontario Woodlot Association Bursary has been established for (1) one student enrolled in any of the following programs:

- Forestry Technician

- Urban Forestry – Arboriculture

The Bursary is open to Canadian citizens, permanent residents and international students. This Bursary is for students at the Pembroke Campus. The Bursary is to be disbursed during the Winter semester.

Roseburg Forest Products Bursary

Roseburg privately owns and sustainably manages more than 600,000 acres of timberland on both coasts of the United States . The annual harvest from our bicoastal footprint ensures the quality and continuity of wood fiber supply to our diverse manufacturing facilities across North America.

Roseburg’s 80-year legacy of philanthropy and service reflects our commitment to making lives better from the ground up. Today, we live that legacy through community sponsorships, scholarships, employee giving, and material donations . We recognize the value in our community and our people. We are proud to employ nearly 3,500 passionate, talented people in a diverse range of positions, from IT to manufacturing to forestry.

This bursary aligns strongly with our commitment and our core values. In giving this bursary, we hope to make a positive impact and difference in the life of an Algonquin College student.

Royal Canadian Legion- Branch 72 Pembroke Bursary

Awarded to a student at the Pembroke Campus during the winter semester who can demonstrate financial need.

Ruth Grant Nursing Bursary

Awarded to a student in the BScN program upon completion of the 2nd year who can demonstrate financial need at the Pembroke Campus.

Sandra Hopper Memorial Bursary

Awarded to students in any health care program offering at the Pembroke Campus who have completed their 1st semester and can demonstrate financial need.

Syd Ford Student Bursary

Awarded to students during level 2 of the Social Service worker program who can demonstrate financial need.

AC Graduation Awards

Get a sense of the awards that you might be eligible by visiting our Convocation website.

Scholarships & Awards

The scholarships and awards listed below are open are various points in the academic year. Please monitor your Live@AC email account for details on completion deadlines.

Campus-Wide Awards

All campus-wide applications can be picked up and returned to:

Kathleen Gaudette

Pembroke Campus, Room 215

613-735-4700 ext. 2701

Email: gaudetk@algonquincollege.com

Alumni Association Award: Awarded to a graduate who exemplifies the greatest concern for the Algonquin College community while at the College.

Annual Award for Excellence: Awarded by the College to a graduating student who has combined outstanding scholastic achievement with demonstrated leadership ability and community participation.

CFDC Scholarship: Available to one student registered in a full-time program at the Algonquin College – Pembroke Campus. The recipient will be pursuing a career in entrepreneurship and business in Renfrew County and demonstrates financial need as well as good academic progress.

Women’s Initiative Network Award: Awarded annually to a woman entering the 2nd semester of a post-secondary program after being absent from formal studies or the workforce for several years. The award will be granted to the applicant who has demonstrated both academic promise and financial need.

Scholarships

Canadian Federation University Women-Ottawa Chapter-Sherrylyn Sarazin Scholarship

Awarded during winter term to a 2nd-year student(s) in either a 2 or 3-year program with a high GPA. The recipient should be an indigenous female student.

Canadian Nuclear Society Scholarship

Awarded to two students in the Applied Nuclear and Radiation Safety program at the Pembroke Campus who have demonstrated a high level of academic achievement during the fall semester.

Canadian Public Works Association Ontario Chapter Scholarship

Awarded to (1) one student enrolled in the Environmental Management and Assessment program. The Scholarship is open to Canadian citizens, permanent residents and international students with a GPA of 3.6 and above.

David Phillipe Duguay Scholarship for Academic Achievement

The David Phillipe Duguay Scholarship for Academic Achievement (the “Scholarship”) has been established for a first-year student enrolled in the Social Service Worker program with a 3.6 GPA or higher. Preference is for a mature student. A mature student is defined as someone who is 25 years of age at the time they are considered for the Scholarship. The Scholarship is open to Canadian citizens, permanent residents and international students. The Scholarship funds will be awarded in the Winter term. This Scholarship is for students at the Ottawa or Pembroke Campus.

Grace Whitmore Scholarship

Awarded to students in the Forestry Technician program at the Pembroke Campus upon completion of level 2 with a high GPA.

Hugh Wright Scholarship

Awarded to an Indigenous student who can demonstrate financial need.

Janeta Neilson and Frank Knaapen Scholarship

Graduating students from the Forestry Technician Program at the Pembroke Campus who have achieved a minimum GPA of 3.6 will receive a $100 scholarship.

Susan Davies Scholarship in Nursing

Awarded annually to a second-year First Nations, Metis or Inuit student, preferably a female, who has achieved the highest GPA in the Practical Nursing Program.

Women’s Business Network Scholarship

The Scholarship is for a student in the graduating year of a two-year business program with a GPA of 3.6 or above. The Scholarship is for a student who is a woman, including trans and intersex women.

Diversifying the Faces of Trades Award Application

This award will provide financial support to an equity-deserving individual entering one of the participating trade programs at Algonquin College. If you identify as being marginalized on the basis of one or more of these protected grounds (Women, 2SLGBTQ+, Indigenous and/or Visible Minority), we invite you to apply for this financial award.

Eligibility Criteria:

- Applicants must self-identify as being marginalized on the basis of one or more of these groups: Women, 2SLGBTQ+, Indigenous and/or Visible Minority

- Applicants must be registered full-time

- Applicants must have a minimum of 3.0 grade point average

- Both International and Domestic (Canadian citizen, a Permanent Resident, or a Protected Person/Convention Refugee) students are encouraged to apply

- Applicants must be enrolled in their first semester of any of the following programs offered at the Ottawa or Pembroke Campus:

- Aircraft Maintenance Technician

- Building Construction Technician

- Cabinetmaking and Furniture Technician

- Carpentry and Renovation Techniques

- Heating, Refrigeration and Air Conditioning Technician

- Mechanical Techniques -Plumbing

- Motive Power Technician

- Motive Power Technician -Diesel Equipment and Truck

- Welding and Fabrication Techniques

Instructions:

- Applicants must add their Social Insurance Number via their ACSIS account in order to be awarded funding. Exceptions may apply for International students

- Applicants will be required to submit an essay or a link to a video submission

- All applicants will be notified of a decision by email after the deadline

Schulich Builders: Scholarships for Skilled Trades

Schulich Builders will combat the shortage of skilled trades in Ontario and amplify their importance and value to our community by awarding 100 annual scholarships to the most promising candidates. Schulich Builders are scholarships for students enrolling in an eligible, full-time skilled trades program at a participating college in Ontario. Ten colleges award a total of 100 scholarships annually. Each college will award ten scholarships.

- 5 students enrolled in an eligible one-year program will receive the Schulich Builders Scholarship valued at $20,000.00

- 5 students enrolled in an eligible two-year program will receive the Schulich Builders Scholarship valued at $40,000.00

Eligible Programs in Pembroke:

Proceed to Application

Helpful Resources

Take a moment to watch this video that gives an overview of the OSAP application process and our various Financial Aid supports at the Pembroke Campus.

Forms & Resources

Hey there! Welcome to the Forms and Resources page. Here we’ve collected information to help you in your quest for knowledge. Have a look around. I hope you have found what you are looking for.

Looking for this?

How-To’s

ACSIS – How to use it

Student Forms

Useful Links

Registrar’s Office Policies

Budgeting Basics

Make yourself a budget by using our handy budgeting template.

This will give you a realistic perspective on where you are financially. Evaluating your spending habits for the past two months will give you a pretty solid indication of how you’re doing. When you calculate how much you’re spending each month, you realize how quickly it all adds up – and it may be much more than you realized.

Ways to save your Money:

- Always use your student discount card or coupons.

- Consider buying used on websites like Kijiji (no one will know the difference).

- Go grocery shopping at Loblaws on Tuesdays and enjoy 10% off for students!

- Bring your own lunch or get the special at Food Services.

For more tips, check out our Money Talks blog post.

External Funding Sources

Contact

Financial worry can be a stressful experience for a student; we can help make that journey a little easier. Financial Aid can assist you with questions regarding federal and provincial student loans as well as with applying for other bursaries and awards that are available to our students.

Students are asked to email financialaidpembroke@algonquincollege.com and provide the following details in their email:

- Student’s full name

- Program

- Student number

- Phone number that you can be reached at

- Plus, your question(s)