Tax Receipts

Algonquin College is required to file your tax receipt forms (T2202) with the Canada Revenue Agency (CRA). We are required to include your Social Insurance Number (SIN) on your tax receipt.

Please ensure that your SIN is updated on ACSIS to make sure you’ll receive your tax receipts on time!

Official Tuition Tax Receipts (T2202)

Your T2202 tax receipts are available online via ACSIS by the end of February, for the previous tax year. For example: Receipts for 2022 will be released in February 2023.

Official Relevé-8/RL-8 (for Québec residents)

To obtain a copy of your Relevé-8/RL-8 Tax Receipt, send your request to Finance. Be sure to include your student number with your request.

Receipts are only issued for qualifying programs and courses. It is not necessary to include the T2202 with your income tax claim; however, it will be required to validate a claim if you are audited.

NOTE: T4’s are not issued to students unless they are also employees of Algonquin College.

All post-secondary institutions are required to record each students’ SIN on the Tuition and Enrolment Certificate (T2202) form and report it to the Canada Revenue Agency (CRA). This was already a requirement for the T4A form, which is released to students who have received awards, including scholarships and bursaries, in the previous tax year.

The T2202 form is an official statement for income tax purposes we must issue to students who have paid tuition and fees for qualifying courses. The tuition tax credit allows you to reduce any income tax you may owe.

Algonquin College, as the issuer of the T2202 and T4A forms, has a legal obligation to ask for and report SINs on such tax documentation. You can find more details on this reporting requirement on CRA’s website (see 2018 Federal Budget Changes Important update for all Designated Educational Institutions, Section 9; see also Important update for all designated educational institutions in Canada — Tuition and Enrolment Certificates

Please be advised that the Income Tax Act requires a person to provide the SIN number to an organization that is required by law to file an information return. The government may impose penalties up to $100 for failure to provide a SIN. You can find information regarding potential penalties at Social Insurance Number guidelines

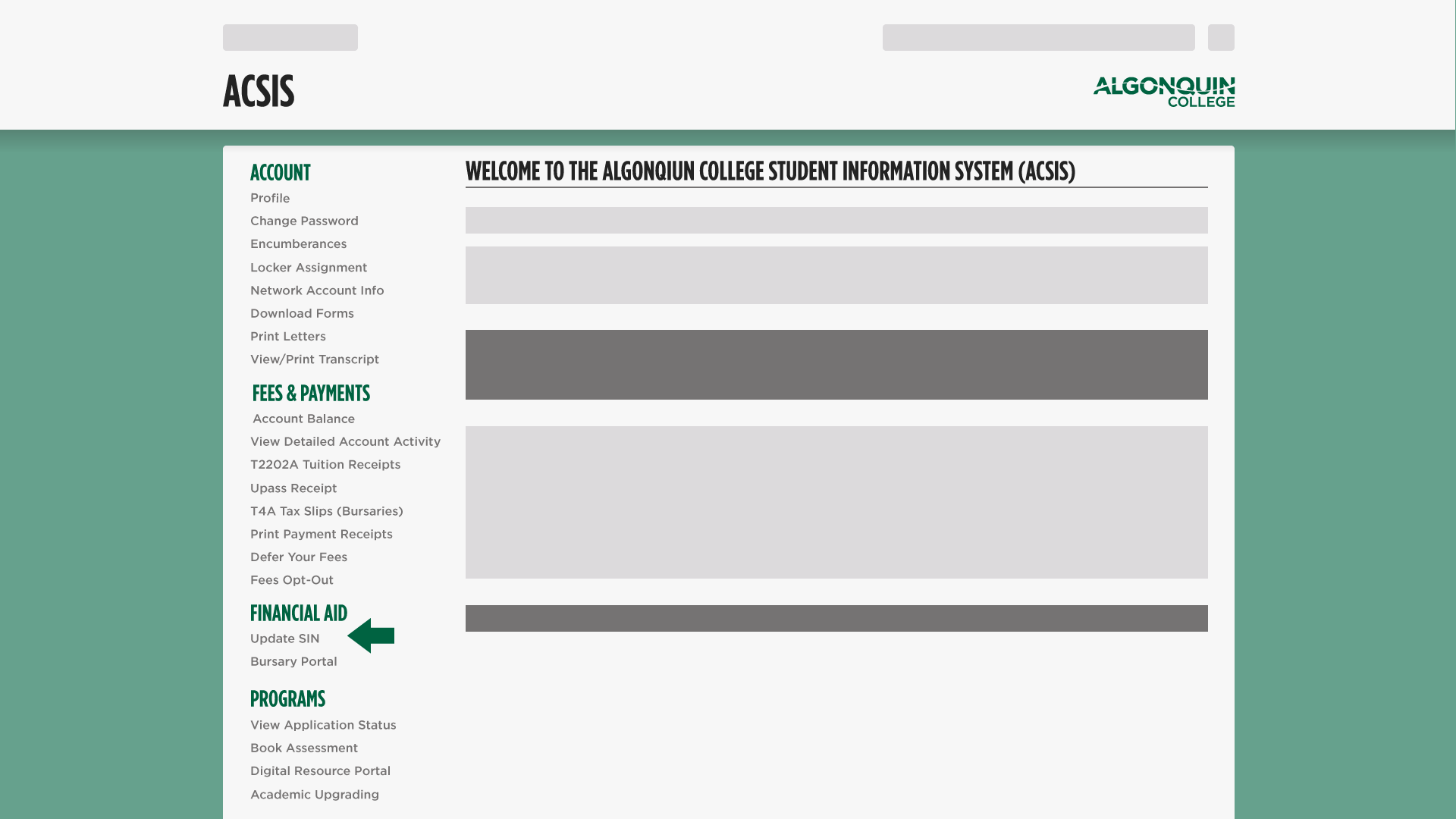

Please add your Social Insurance Number in ACSIS.

Follow these steps

- Log in. Not sure how? Watch the video.

- Click ‘Update SIN’ under ‘Financial Aid’.

You can find more details and tutorials on this page.

Important: Remember to only add your SIN number in ACSIS. We want to assure you that the College stays abreast of current, constantly evolving cyber threats and has implemented adequate security measures, including encryption, to ensure the protection of the information students entrust to us.

Sponsored Students

A T2202 is issued to the student. If a student is sponsored, the sponsor will issue a T4A for the amount paid on the student’s behalf. The student must claim the sponsored amount as income and can claim the tuition credit or allocate it to a parent/guardian if applicable.

Please note that for post-secondary credit activity, fees are prorated over the learning period and are not always credited in the year of payment.

T4A tax receipts for bursaries

T4A tax receipts are available on ACSIS on March 1.

Have questions about your Tax Receipts? Check out our Frequently Asked Questions page.

For more information, please check the Government of Canada’s website.